Dan S. Kennedy’s classic No BS Marketing to the Affluent is in its third edition.

Since we’re in aviation marketing and our target market fits the category of “affluent consumer,” we HAD to read it.

And of course, we talk about the current Covid 19 situation and its effect on aviation, because, how could we not?

Mickey Gamonal of Gamonal Tutors, Debbie Murphy of JetBrokers, Joni Schultz from Jim Gardner Aviation Insurance, and John and Paula Williams of ABCI discussed the book, including our key takeways and leave behinds in this animated discussion.

Follow us on social media, and like and subscribe to our channel here for more book club discussions and aviation marketing topics!

Facebook: https://facebook.com/marketingforaviation

Twitter: https://twitter.com/paula_abci

Instagram: https://instagram.com/paula_abci

Transcript – Marketing to the Affluent

[fusebox_track_player url=”https://aviationmarketing.libsyn.com/book-club-discussion-no-bs-marketing-to-the-affluent-by-dan-s-kennedy” background=”default” ]

Mickey Gamonal:

First things first, introductions. My name is Mickey Gamonal. I’m with Gamonal Tutors LLC, and I am the offspring of the great Paula Williams. She is the one kind of running the business. So she’s got the ABCI, and well, I’ll let her speak for herself.

Paula Williams:

Okay. I’m Paula Williams, ABCI, and we help aviation companies sell more of their products and services. And I am also Mickey’s mom, which is an even greater accomplishment.

Mickey Gamonal:

Cool. John, do you want to go ahead? And then we’ll go in order of who showed up.

John Williams:

Yeah, and I’m the finance guy for ABCI, and I also do all kinds of backend stuff for her. Support however I can, and do business consulting on the side actually.

Paula Williams:

Which is how you know affluent people, right?

Debbie Murphy:

Hi, I’m Debbie Murphy. I am the VP of Marketing for JetBrokers. We sell corporate jets. And do you want us to say what we think affluence is? Or just want us to do this first?

Mickey Gamonal:

No, go for it. Hit the affluence, because I’ll probably be talking about affluence for a while anyway. So yeah, definitely. What does it mean to you?

Debbie Murphy:

What it means to me is someone who can actually afford to buy and fly a jet, because that’s my business. So if you just have a big house and you have a lot of cars, that’s sort of affluent, but…

Mickey Gamonal:

So what does defines-

Debbie Murphy:

Well, you have to have many more than a million dollars to really be able to do that.

John Williams:

Yeah, and you had said something very important, not just buy, but and buy.

Debbie Murphy:

Fly, pay for your crew, pay for the fuel, maintenance.

John Williams:

Yeah, there’s all that stuff.

Debbie Murphy:

Yeah. To me, that’s what affluent is, but that’s probably because it’s skewed for my business.

John Williams:

Yep.

Mickey Gamonal:

No, no, that’s great. But the book kind of talks about how it’s skewed all around anyways, because it’s really tough to measure. Affluence, it’s definitely not a bell curve, that’s for sure.

Debbie Murphy:

No.

Mickey Gamonal:

And then, Joni, do you want to do ahead?

Joni Schultz:

Well, I’m Joni Schultz. I am an aviation insurance broker and past underwriter for corporate, actually mostly corporate jets. I was the person who, for a long time, AAU, which was one of the premiere, is now Global Aero, but that was what I did. I underwrote corporate jets and that sort of stuff. Now I just sell aviation insurance to all aspects of aviation. Anyway, I’m an essential worker in some states. That’s a joke. That’s a joke. Affluent, oh my goodness. Well, I guess the question is, in the aviation realm, are we talking? Or we’re just talking about life?

Mickey Gamonal:

Just generally, because we’re going with the book. So it’s going to be, generally, people can afford stuff, but however you say it.

Joni Schultz:

Yeah, because I have to agree that just because you can buy something, doesn’t mean that you have the money to maintain everything that goes along with it. So yeah, I mean. And maybe those affluent people have a stream of income that will last them through having to think about all those other extra costs.

Mickey Gamonal:

Yeah, absolutely. So do you agree? And I’m sorry. It was Debbie, right?

Debbie Murphy:

Yes.

Mickey Gamonal:

Okay. Do you agree with Debbie, Joni, then that affluence is millions of dollars in the bank? Is that the level of affluence?

Joni Schultz:

No. Millions of dollars in the bank or a stream of income to support whatever you’re doing.

Mickey Gamonal:

Okay.

Joni Schultz:

Yeah, one of the two, because I mean, of course, that’s a leap of faith because we know that all that can stop in a moment, don’t we?

Mickey Gamonal:

If we’re sure of anything now it’s that nothing’s for sure, right?

Joni Schultz:

Exactly.

Mickey Gamonal:

Even with email.

John Williams:

And actually, these days, millions of dollars in the bank is not much.

Joni Schultz:

It’s not an option.

Paula Williams:

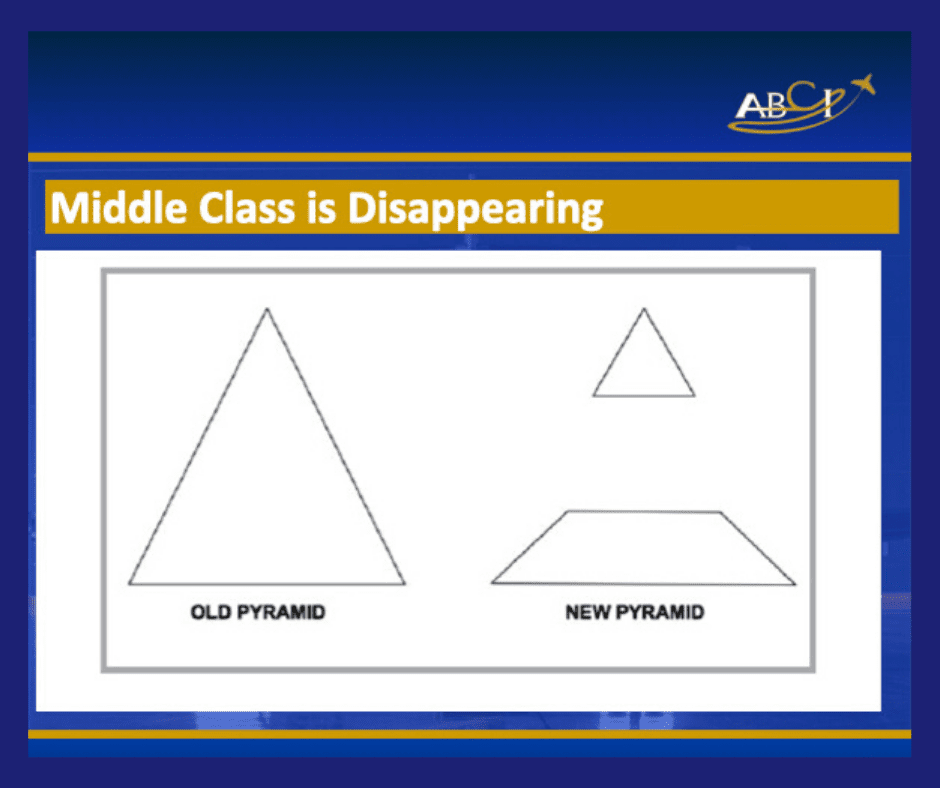

Yeah, right. I think for the purpose of the book, they have a pyramid and they’ve got a three section pyramid, where you’ve got lower class, middle class, and affluent as kind of the only three distinctions that they make in the book. Of course, other people do ultra high net worth, high net worth, and it’s all numbers, but I think he’s talking, culturally, the middle class is disappearing, and so the pyramid is kind of squishing into a figure eight, I think is his argument. Would you agree?

Mickey Gamonal:

Mm-hmm (affirmative). Yeah, absolutely. Absolutely. From what I read in the book, there’s even a picture of a perfect triangle, and then a picture next to it of a little triangle on top and a big triangle on bottom, which represents this small population of people who have and this large population of people who have not, and it’s shifting more and more in that direction. I agree that’s the argument that he’s making.

Paula Williams:

In the middle of disappearing.

Mickey Gamonal:

Yeah, exactly. One thing that’s interesting is the difference in affluence. For me, since I’m just a tutor, the most I made was somebody who was giving me a $1,000.00 a month. Right? And this was kind of like on the side, but people who work with more expensive things have a completely different idea of what affluence is, and that leads me into my first point.

So I’m going to go first with my first point, and we’ll just do one point each, and then if we have more time, we can do other points. But my first point is going to be, right in the beginning, he hits it right off the bat. It’s a comparative study, which is great, because that’s what I like. I like math, I like numbers, I like comparing things and critical thinking. I’m all about that life.

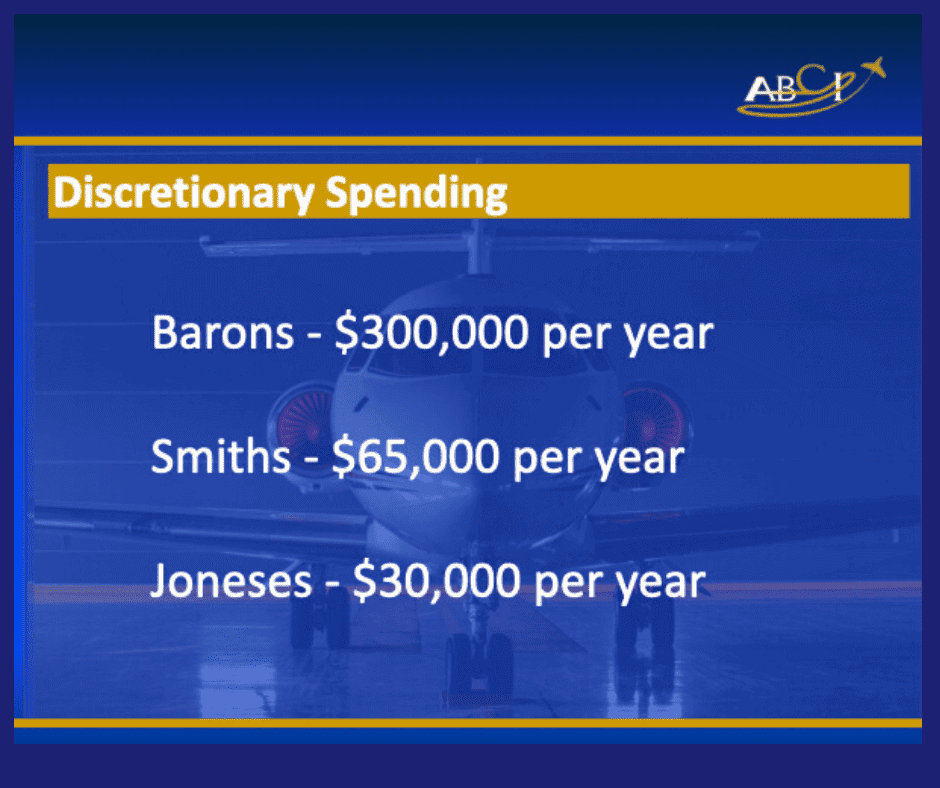

So he compares the Baron’s, the Smith’s, and the Jones’s. So the Baron’s make $300,000.00 per year. The Smith’s make $65,000.00 per year, and the Jones’s make $30,000.00 per year, and from what I’m hearing, it’s possible that not even the Baron’s are flying jets around. Right? It sounds like there’s a whole nother different levels out there, but he makes the argument of selling to the Baron’s before the Jones’s, and he makes it really clear.

Basically, everyone who is alive in the United States, everyone who’s buying things, needs to pay for their essential expenses. Right? And we’ve all, in the past two months, have become very familiar with what is essential and what is not, but you need to cover your food, you need to cover your insurance, you need to pay your cell phone, you need to pay your internet. Whatever it is, the baseline of existence in the cost of living that you’re accustomed to is what you’re going to pay.

Now of course, the Baron’s, who make $300,000.00 per year, their baseline’s higher, but it’s not significantly higher and that’s the point that he makes. It’s significantly higher to the Jones’s, who are at the lower end of the scale, but in the grand scheme of things, it’s only double what the Jones’s pay.

Paula Williams:

Not 10 times. Right.

Mickey Gamonal:

Exactly, exactly. If you look at how much the Jones’s have to pay, true, they’re paying less insurance because they don’t have to pay for insurance on a bigger house and bigger cars and stuff like that. But at the end of the day, they’re paying about the same in gas. Most of the expenses are going to be about the same.

So the final hard stat that I really liked was that 25% of the Baron’s $300,000.00 per year is spent on essentials, and 58% of the Smith’s $65,000.00 per year is spent on essentials, and the Jones’s, 85% is spent on the essential items. So how much they’re making, I don’t really think about that too much. Right? $300,000.00, they’re making $300,000.00. I’m obviously not going to get all of their money, but how much they’re spending on essentials and how much they have left over, well the Baron’s have 75% of $300,000.00, which is a pretty good chunk. That’s way more than the Smith’s or the Jones’s make.

The Smith’s have less than half of their $65,000.00 to spend on whatever they want, and the Jones’s only have 15%. And so that’s why the Jones’s are going to be bargain shopping. That’s why they’re looking more value for your money, while the Baron’s are looking for service. Right? They’re not so concerned about, “Oh, this is going to take a bigger chunk of my leftover cash.” Their main concern is, is this going to work? Which just liberates them to make more money, which could be the cycle as to why affluence kind of grows in that way and the other side doesn’t, but that’s kind of beside the point.

The point is that you’re buying and selling. Does that sound about right? Did anybody else read the comparative study and have something to add on that?

Paula Williams:

I think that’s right on, and the one thing that I would add would be that the Baron’s, and assuming that it’s anybody over $300,000.00, they’re not the Kardashians. I mean, we think of the affluent. We have this idea in our heads of what affluent people are like, especially if you’re a young person, and there’s a lot of people in our coaching program that haven’t really had much experience with affluent people and they feel a little oogy about them, but they’re not the Kardashians. They have parents, they have kids, they have all the same things that the Smiths and the Jones’s have. It’s just that they have more options for how they’re going to take care of their kids and how they’re going to take care of their parents, and the fact that they can get from point A to point B without getting them on an airliner.

So I think it’s just numbers. It’s not necessarily personality or anything else, because there are penny pinchers. These are the kind of people that are still telling their kids to turn off the lights to save money, but they will spend money on saving time and on being safe. Right?

Mickey Gamonal:

Yeah, absolutely. I completely agree. Yeah, and there’s a part in the book too, where it says he thinks we go to the zoo and we look at other creatures and we think of affluent people like these other creatures, and they’re not. They’re definitely just more humans, more just like us, and they want the exact same thing, pretty much nothing different. They just have more options of what they can get. So yeah, I think you’re spot on. Cool. Awesome, so that was my point. awesome. That’s my one point that I wanted to really drive home. Who wants to go next?

Joni Schultz:

I already went, so John, you want to go next?

John Williams:

Well, what may not come clear in the book is the fact that Dan started selling paperback books. So he started with nothing, and the last time that he and I talked, he is up to the point where he could buy a jet and fly it, but refuses to. He’ll take a private jet, 135 operation for you other guys, and he does that or did that frequently. But from selling, I get this. From selling paperback books, the last year that he will talk about where he did consulting services, what was it Paula? Six month in advance to schedule time with him?

Paula Williams:

Yep, and he only did days. He didn’t do half days anymore, so you had to do a full day.

John Williams:

Yeah, minimum of three days at $700,000.00 a day.

Paula Williams:

Right.

Mickey Gamonal:

Wow.

John Williams:

Now, this guy knows his stuff. You may not like his style, but he’s a straight shooter. You know where you stand when you talk to him and I like that kind of guy.

Paula Williams:

Mm-hmm (affirmative). He’s had some health problems, but he’s back I guess. He’s been studying and he’s writing books and things.

John Williams:

He wrote his own obituary, but then-

Paula Williams:

And then he didn’t die.

John Williams:

But he didn’t die. He came back and now he’s healthy again and ready to rock, ready to roll.

Mickey Gamonal:

Can you imagine what this guy thinks? He’s like, “Oh man, I got to revise it.”

Paula Williams:

Right?

Mickey Gamonal:

I’m just having visions of, “I can’t believe I used the wrong Dan.”

Paula Williams:

Well, he was in hospice, so I mean, he was really in bad shape, but he did come back, so that’s a wonderful thing.

John Williams:

But I mean, I understand what he’s saying and I think maybe the middle class is starting to make a come back, and we’ll see. Up until this virus thing happened, we’ll see. But I could go off in a different direction, so I probably should just stop there.

Paula Williams:

Okay.

Mickey Gamonal:

Right? No, everybody’s making predictions on what’s coming next. That’s everybody’s favorite. That’s all we have time to do anymore, right?

Paula Williams:

Mm-hmm (affirmative).

Debbie Murphy:

I’ve been busy. I haven’t stopped working at all. I’ve been busier than I was before it and I can’t even leave the house.

Mickey Gamonal:

Really?

Debbie Murphy:

Yeah.

Mickey Gamonal:

Gosh.

John Williams:

Yeah. I mean, we-

Debbie Murphy:

It’s not bad.

John Williams:

We haven’t stopped working either. I mean, it’s like nothing changed, except we can’t go out to dinner.

Paula Williams:

Right.

Debbie Murphy:

And I look a little different because I can’t my hair done, but that’s another story.

John Williams:

Yeah, me too.

Debbie Murphy:

I look a little crazy, but it’s kind of nice in a way, so whatever.

Mickey Gamonal:

Heck, yeah. There’s some liberties. There’s some liberation that comes with this whole stay in and shelter in place thing.

Debbie Murphy:

I started planting. Instead of flowers, I planted salad stuff in my pots this year, so I have lettuce growing, which is really funny, but I don’t have to clean it in my driveway. Where I have it planted, it’s fine. I just pick it and eat it.

So I guess the thing that I thought, I don’t know what I was supposed to talk about, but they have a section in here about affluent money spending on travel, which I think is appropriate for what we do, and it says they are moving away from spending on things and moving more towards experiential. So he divides them into three groups, affluent jet setters, affluent taste for first class, and affluent domestic deal seekers. So the affluent jet setters, 31% owned their own business, 44% are C-suiters, 65% are men, 27% from the west coast. They’re highly engaged, frequent business and vacation travelers, so that’s interesting.

Paula Williams:

Yeah.

Debbie Murphy:

Absolute taste for first class. 32% millennial, 38% Gen-Xers and 27% boomers. They splurge on upgrades, such as first class flight upgrades and fine food and wine. And then they have the domestic deal seekers, which we do get, people who are buying planes, who are deal seekers.

Paula Williams:

Right? The Baron flyers and things like that and the-

Debbie Murphy:

Yeah, it’s kind of good to figure out what they’re doing, so that’s interesting.

Paula Williams:

Yeah.

Mickey Gamonal:

No, that’s cool. That’s cool. Yeah, and that’s one thing that I like about this book, is it definitely breaks down, I mean, the minutia, man. He goes down into the LBGTQ community, which is not something I would have expected him to do, just based off of his opening, his kind of trumpeter, which kind of like, you lump people into boxes, and the fact that he is just focused on every specificity of class of person, type of person, and what they want really speaks to his ability as an advertiser. Right? Or his ability as a marketer, because he recognizes that it’s not about him.

That’s the best part of the whole book, is that the book’s not about him. It’s about how we or anyone can make lots of money selling to the affluent. So that is one of the best parts, for sure. Yeah. One thing that jumped out to me in those stats you were reading is that the jet setters are on the west coast, and I’m currently in San Jose, California right now, so I’m in the west coast, and some of the houses are pretty nice. Silicon Valley is something else. It’s pretty cool out here, for sure.

Debbie Murphy:

True.

Mickey Gamonal:

Yeah.

Debbie Murphy:

It’s also interesting because when we do marketing, we divide people into segmenting. We’re always adding some information to our marketing files about people. So he kind of gives you more ideas of what you should think about.

Paula Williams:

Right? The more segmentation, the better. Right?

Debbie Murphy:

Yeah, right.

Mickey Gamonal:

Yeah. I’ve heard that too. I’ve heard that too. I’m trying to do this new tutoring coaching program and the guy who’s running the coaching program is like, “You need to be as specific as possible,” which of course is what my mom has been saying for years. It’s different.

Debbie Murphy:

I can hear Paula saying that.

Paula Williams:

Just need to hear a different perspective though, and this hearing millennial, the thing that you’re doing, so it’s a nice perspective.

Mickey Gamonal:

Yeah. No, that’s great. And then one thing that you mentioned, John, about how Dan Kennedy went from selling paperback books or whatever to as much money as he’s making now. Speaking of the subsets, one of the subsets he has in here was… What was it? I think he calls them the rags to riches. Yeah. Going from poor to rich, selling to the self employed affluent, and just based off of those jet setter stats too, the entrepreneurs, these are the people who went out and built their own thing.

And one of the main things that they’re looking for is, they want respect. They don’t want people to think that they came by their money easily, and I think that’s something that we forget. Well, personally that I forget working with affluent people is that they’re the Kardashians, just like my mom said. Joni, did you have something to share on this?

Joni Schultz:

I did realize that I don’t have that book actually, or if I do, it’s somewhere else. But I just wanted to share something. Debra, today was one of our keynote speaker segments from the AIA conference. That didn’t happen, so we’ve been doing little Zoom meetings, and today was Mark Baker from AOPA, spoke to us and it was probably my favorite keynote. But just like before all of this hit, the video conferencing and stuff was just like that thing that was sitting over there, and now look at it. If you can imagine what the stock is today, I haven’t looked, but it’s amazing, the change, because we’ve been all bombarded into that.

But what he was saying about general aviation, it’s actually grown since all of this started because people are realizing that their way of transportation may not come back the way they wanted it to and people can’t get from point A to point B. So really, people are realizing that GA is an avenue that they can go to, which is actually encouraging to me, because we-

Debbie Murphy:

We have people who want their own aircraft, who’ve shared aircraft before. We’re showing planes. We have people that, “You need to find it. What?”

Joni Schultz:

And, of course, combine that with the fact that the interest rates are low, and as long as they have a way to pay for it, right, you’ve got to have that because you can’t get something without that. But I mean, we’re just resilient I think, in that we will look at different ways to get things done. Thank goodness we have God given creative minds that we have because we-

Debbie Murphy:

We have a strong urge to survive too.

Joni Schultz:

We do.

Debbie Murphy:

And I think we work out a creative way to get that done to survive.

Joni Schultz:

Exactly. And so, I guess I was really encouraged by that, because my husband and I both love general aviation. We’re part of it, and it was sad to see the average age of the pilot going up and up and up and not seeing anything else coming. And I’ve always been one to say, “Hey, if you’ve got a business, have you ever thought about working your business and using an airplane to do it?” So anyway, that’s-

Debbie Murphy:

Yeah. You can go farther, go faster.

Joni Schultz:

You can. Faster, and it’s just going to generate some stimulus in that area because flight schools are still doing great. I mean, I’m encouraged and it’s kind of departing from the book and all of that, but I think that I was hoping to encourage somebody else today with that information.

Debbie Murphy:

I’m glad you shared it. Thank you.

Joni Schultz:

You’re welcome.

Paula Williams:

Yeah. We all need encouraging news.

Joni Schultz:

Yeah, for sure. Yeah, because it’s kind of odd. But anyway, I don’t know if that answers it.

Mickey Gamonal:

No, I think it does. I mean, well even if it’s outside of the book, I think you’re right. Aviation, I always thought that it would take one of the biggest hits right now, so that’s great to hear that it’s still flying. It’s going up.

Debbie Murphy:

Well, if I could afford to buy myself a plane right now, I would certainly have one.

Paula Williams:

Right? Prices are down, fuel is down. There’s a lot of reason.

Debbie Murphy:

I could go see my sister in Connecticut. I can’t do that right now. Take my mom away somewhere.

Paula Williams:

Right? Go convalesce on a beach somewhere, quarantine yourself some place nice.

Debbie Murphy:

Some place. This is nice, but it could be nicer.

Joni Schultz:

Oh, yeah.

Mickey Gamonal:

Sweet. No, great. Cool. I’ll bring it back to one more point, the last point I have on the book, just to circle it back around, and then of course, we’ll do some wrap up stuff, but I like everything that everybody’s sharing so far for sure.

The last one that I liked, because like I said, I’m doing a coaching program right now for social media, so there’s a social media marketing page kind of towards the back in book four, and basically the stat that he opens with, and just like as Debbie pointed out earlier, this stats that they open with in this book is great, because you look through this book, you find the section of the person that you want to work with or the idea that you want to look into, education or marketing to such and such, or what have you, or social media, and then you flip to that page, boom. He hits you with a statistic that kind of changes your mentality, or at least makes you think twice.

And the social media statistic that I really liked was at the beginning, is a quarter of all purchases are influenced by social media. So I think that’s completely true and completely relevant. I mean, social media, everybody’s saying, “It’s taking over our lives, dah, dah, dah, dah. We spend so much time on social media.” But a quarter of our purchases, I think it might even be a little low, especially right now, because you’re spending so much time with social media. That usually where a lot of the marketing’s going to come from.

And then I was thinking about it like, “Oh, how many purchases do I make a week?” And we’re in quarantine, so I haven’t been buying new stuff all over the place. I’ve just gone to the grocery store once in a while, picked up some gas, but I know that I’m making well over an average of seven purchases a week. I know I’m purchasing more than one thing per day, and I would bet that well over a quarter, especially the things that aren’t my essentials, well over a quarter of that is being influenced by social media. So I just thought that was super relevant. Anybody have anything to add on that?

John Williams:

Yeah. When you say influenced by social media, exactly how do you mean?

Mickey Gamonal:

So what I mean is that there are either, A, paid ads, or B, product placement. Right? So if my buddy’s saying, “Check out this new pair of shoes that I got,” or something like that, and that’s what people do. That’s what people use social media for. It’s a great place for bragging and celebrating your success and stuff like that.

So one of the first things you see when somebody buys a new car, boom, the new car’s in a post. “God is good,” or whatever tagline they want to throw in there to make it ultra pure, but at the end of the day, they’re schlepping a Volkswagen.

Paula Williams:

Right.

Mickey Gamonal:

And I think that’s interesting. It’s great. It’s great.

Paula Williams:

Two words, John. Electric skateboard.

Debbie Murphy:

Ut-oh.

Paula Williams:

Exactly. No, but people see things and it may be something they’ve never heard or they never knew that they wanted, and then all of a sudden, you’re sharing a video and showing everybody that you know about this electric skateboard. That’s how people share things nowadays.

John Williams:

You don’t even know. I saw an electric skateboard. Right? I mean, I was going up a hill and I saw a skateboard that’s going down beside me, and I started up the hill and noticed that not only is he going up the hill, but he’s going faster than I am, and I thought, “What the hell?” So that was pretty cool, and then I went to several skateboard shops around town, as I had time, and nobody’s got them.

They do however have a one wheel skateboard, where it’s just one wheel in the center and you put a foot on either side of it, and it’s basically invented by people that did snowboarding so they could practice in the summertime. That thing’s a real kick. Man, you can rent that thing $15.00 for 15 minutes and I did. Takes two minutes to learn how to use it, and probably the rest of your life to get really good at it, but it’s crazy.

And then after I was on it a bit, I asked the guy. I said, “You probably think I’m crazy,” I said, “But I’ve always wanted to learn how to snowboard because I’m a skier, but would this have any help? Would this assist me in learning the snowboarding?”

He said, “Absolutely, because you get used to this, you’ve got the weight transfer down and the stance on a board.”

Mickey Gamonal:

Mm-hmm (affirmative), it’s great for that.

John Williams:

And so probably 10 minutes being on snowboard at least for going down small hills.

Paula Williams:

Right. But the point is that something novel or cool is something that people share on social media, even you, and I know you’re a social media skeptic.

John Williams:

I did not share it on social media.

Paula Williams:

But you shared it in person.

John Williams:

I took a video of it and I showed it individually to people.

Paula Williams:

Right.

Mickey Gamonal:

Well, even without you sharing one wheel, I’ve been following Onewheel on Instagram for a good seven, eight months and it’s ever since they posted their ads. I went through and I was like, “Wow, this is really cool.” And then I started following them.

So the day that I finally buy one, hopefully it’ll be a long time from now so I can focus on more important purchases, but the day that I finally buy one, it will definitely have been social media that influenced it for sure.

John Williams:

They are a little pricey. The bigger one, which is what I want, is around $2,000.00 currently.

Paula Williams:

Right.

Mickey Gamonal:

But worth it. That wind in your hair, you can’t beat that.

John Williams:

I know. Anyway, it never hurts.

Paula Williams:

Right. But anyway, even for affluent people, even for older people, even for other folks like that, there is still that impulse to share something cool. That lends itself really well to social media. Right?

Debbie Murphy:

And I think that’s amplified right now, since people are not seeing each other as often in person.

Paula Williams:

Right.

Debbie Murphy:

They’re becoming more used to seeing each other on video or on Facebook or wherever it is people congregate.

John Williams:

So how do you identify somebody that’s “affluent” if you just meet them or you’re researching them? I mean, you can’t really get in their bank account and you don’t know what their investments are, so how do you know that they can afford the product you want or the products you’re willing to charge? I mean, how do you know this?

Mickey Gamonal:

I mean, the book isn’t spotting affluence. I honestly have no answer. Go ahead.

Paula Williams:

I was just going to say, this is really about targeting people who are affluent, so that they’re already qualified by the time you make contact with them. Right?

Mickey Gamonal:

Yeah. Yeah. I think it’s more focused on reaching out to them, right? And being specific.

John Williams:

A good example, I mean, Dan himself has a hobby of racing horses, and horses are not cheap, much less the racing variety, much less the upkeep.

Paula Williams:

Right?

Debbie Murphy:

Like owning plane level again.

John Williams:

Pretty much.

Debbie Murphy:

Yeah.

John Williams:

And he owns several.

Debbie Murphy:

That’s okay.

John Williams:

He races several, so I mean, you know.

Paula Williams:

Right. But I think to your point, you can’t tell anymore. You can’t disqualify someone by what they’re wearing or the way that they speak or anything else, especially nowadays. So I think it’s really important to not disqualify somebody, thinking that they’re not affluent, when they could be.

John Williams:

Yes. That was where I was going with it.

Paula Williams:

Okay.

Mickey Gamonal:

Nice. Yeah, I can agree with that. It’s funny. He talks about his horseracing all the time too. He says that he bought a house in the middle of nowhere, but it’s close to the horse track, and he talks about this diamond seller, his diamond vendor that is just one diamond vendor, which is located inside of the horse auction, and the reason that they’re there is so that when someone like Dan Kennedy comes home and his wife says, “You did not buy another stupid horse,” he says, “But I got you earrings,” and that’s exactly what this place was built for, and if that’s not marketing to the affluent, if that’s not targeting and placement, man, I don’t know.

Debbie Murphy:

That’s funny.

Paula Williams:

Brilliant. No, I think that’s excellent and there’s a lot of aviation people that sell at Harley shops and other places where they know affluent people. There’s a local airport, they have a Harley shop that’s nearby, or a yacht club or something like that, so there’s a lot of crossover there.

Debbie Murphy:

Or they buy and sell the Harleys, like my brother does. He has a whole garage full of them.

Paula Williams:

Wow.

John Williams:

Or if you guys have been to MBAA and noticed that they sell yachts at MBAA.

Debbie Murphy:

Oh, yeah.

Paula Williams:

And putters.

Debbie Murphy:

Makes sense.

Paula Williams:

I like his story about the $6,800.00 putter. Oh, $680.00 putter. It wasn’t that bad. $680.00 putter, but the guy who bought it is yelling at his grandkids to turn the lights off because he doesn’t want to be wasting money on the electric bill.

Debbie Murphy:

Priorities.

Paula Williams:

Right? Priorities, absolutely.

Joni Schultz:

We always pay for what we want, right?

Paula Williams:

Yeah, definitely. I think everybody has their thing and this is a point that a lot of folks have real trouble with. They’re working with these aircraft owners that are spending millions of dollars on their aircraft, but then they don’t want to spend an extra $500.00 to get their log books digitized or something like that. That doesn’t make any sense from a practical perspective, but not every decision is practical, even by these people that are supposedly so smart, so that’s funny.

Debbie Murphy:

Could be because they were often to be entrepreneurs and like to control their situation.

Paula Williams:

That’s true. That’s true. But yeah, you do have to find their point where they’re willing and able to spend money and make a connection to that in some way.

Mickey Gamonal:

Nice, great.

Debbie Murphy:

So I noticed they have a section about affluent boomers spending boom. 75% of boomers have a household income of over a $100,000.00 and they’re the wealthiest generation in history. Well, they’re who we’re targeting right now for our buy your plane, don’t share-

Paula Williams:

Yeah, campaign.

Debbie Murphy:

… social media campaign. So that’s-

Paula Williams:

Right.

Mickey Gamonal:

Can you talk about it? Can you talk about how you target or your message or anything like that? Any specifics?

Debbie Murphy:

Well, we’re still in the process. Working with Paula and John, we discussed it in our meeting last week. We’re going to target NetJets and people, fractional users on Facebook basically, but we know that it’s going to be boomers because they are who are calling us.

They say, “I’m older. I don’t want to share a cabin with somebody else. I don’t have to, I have the money. I want this size plane and we want it now.” I have two people doing it right now without even advertising, so we know that’s the place to go.

Paula Williams:

Yep. “And I want to keep my own stuff on the airplane. I want my own crew, I want my own cleaning procedure done every time, I want control of all that.”

Debbie Murphy:

Yeah. “And I want to be able to lock it and leave my things on it.” Just, they want that separation.

John Williams:

Not only that, but it’s going to be absolutely ludicrous to try to fly on an airline for the next couple years.

Debbie Murphy:

And you won’t want to go through the airport, nevermind the plane.

John Williams:

No, no.

Debbie Murphy:

It’s just, the plane is going to be clean compared to the rest of the place.

John Williams:

Right, yeah.

Debbie Murphy:

So I think affluent aviation is going to be doing a lot better.

Joni Schultz:

And the hours that are going to take to just get to the aircraft itself, is everybody going to have to have their temperature taken? Can you imagine those lines?

Debbie Murphy:

How are you going to stay six feet apart in a line?

Joni Schultz:

Yeah, nothing.

Debbie Murphy:

Down the street, down the road and out of the airport.

Paula Williams:

We need bigger airports.

Debbie Murphy:

Yeah.

Mickey Gamonal:

Well, can you imagine telling TSA to stay six feet back?

Paula Williams:

Yeah. “Don’t touch me. Don’t touch me, yeah. Put your mask on.”

Mickey Gamonal:

You need a longer wall to put-

Debbie Murphy:

Hopefully, they’re wearing it for their own sake.

Mickey Gamonal:

Geez, that’s crazy.

John Williams:

I’m going to send everybody a text. I mean, it’s a website talking about the fact that airplanes don’t make you sick.

Debbie Murphy:

I saw that. I saw an article on that already. They said you’re more likely to catch it in the airport.

Mickey Gamonal:

I’m just going to do like key takeaway, key leave behind, and we’ll just do the same order and go around.

Paula Williams:

That’s good.

Mickey Gamonal:

But my key takeaway, two things. One, always show respect, because just like you were talking about with the boomers, as well as the self made affluent and everything like that, respect is the most key thing. Money, it doesn’t necessarily mean less to those who have more of it. It can still mean the same amount and they still know the value of a dollar as much as anybody else. I think that’s something we tend to forget, or I tend to forget anyways.

One thing that I would leave behind in this book, man, it’s very specific, but it covers too many topics for me. So I would try not to read it onc chapter at a time, which is what I did for the first couple books or the first couple subsections in there. I think I would’ve gotten a little bit more if I was more specific and intentional and highlighted the top four chapters, and then went through. So those are my key takeaways and leave behinds.

Paula Williams:

Right.

Debbie Murphy:

Since I didn’t read the whole book, I will read it, but I’m going to probably skim it towards the topics that look like they suit my purposes.

Mickey Gamonal:

Cool.

Paula Williams:

Yeah. Money is not the limiting factor. It’s time, and I think that’s becoming more obvious as time goes on for us and as we learn more about customers and as we learn more about people. They want to save time more than they want to save money. And so, I think reducing prices to try and get people to buy doesn’t work as effectively as saying, “We can get you to your result faster. We can save you time.” That’s a more compelling argument than we can save you money.

And then as far as a leave behind goes, I so wish there was a book like this that was specifically for aviation. So the Baron’s make $300,000.00 a year. A lot of the qualifiers for our clients is a lot higher than that, so I would love to see a book like this, with statistics like this, that is as well written as this for the aviation market and talking about those kind of people.

John Williams:

Yeah, and it’s exactly right, because the Baron’s would have to make at least $30 million annually to be able to afford an airplane, and that’s a small one at that, and the Smith’s and Jones’s just wouldn’t be in the running. I mean, they could get a small airplane to play with on weekends, but that’d be it.

Paula Williams:

Right. And they wrote a version of this book 10 years ago. Well, I don’t know when the first version came out. This is the third iteration. They haven’t changed these numbers, so I think that’s part of the problem.

Debbie Murphy:

Okay. Yeah.

Paula Williams:

Joni? Oh, I’m sorry. I’m doing your job, Mickey. Sorry.

Mickey Gamonal:

No, you’re good. You’re good. This is my first time too so I appreciate the help. Go for it.

Joni Schultz:

Well, I think, I guess I go back to… I’m not sure who said it, if it was Deb or Paula, but you really don’t ever know, I mean, unless you have an association with a person, you’ve done some background, you know what they do, like they’re part of the race horses, because we all know that’s an expensive hobby, just like aviation is an expensive hobby too, especially in the helicopter world where I lived in my nonprofit service.

So we know that they have money, but I mean, I guess go back to the fact that I’m going to serve my customer the same, because you never know what that person’s going to do or what they really do that they’re not sharing or whatever. I’m just going to treat every customer the same.

As far as marketing goes, our agency is built on the trust. We want you to trust us with your business because we’re here to represent you, because that’s the definition of the broker as opposed to an agent in the insurance world. An agent represents the company. A broker represents the customer. And so I go back to the basics, and if you treat your customers well, they’re going to tell other people about you.

And there’s a helicopter operator in New Hampshire that’s never once advertised in his entire business for 40 years. But you know what? Everybody else tells everybody else about him. I mean, he doesn’t need to. That is something when you can have reputation that you don’t need to advertise because everybody does it for you, that’s worked with you. He’s a straight shooter, John. I think you’d like him.

John Williams:

I probably would.

Joni Schultz:

What you see is what you get, and he’s from New Hampshire, and I’ll tell you, he’ll tell you, but you may not like it, but he won’t tell you a different story two days later.

John Williams:

Exactly.

Joni Schultz:

It’s what he is and that’s it. I just looked at the title. I have the other book, which is No B.S. Sales Success in The New Economy, so you might have to go back to reviewing that one.

Paula Williams:

There you go. Exactly.

Joni Schultz:

Maybe we ought to review it. But that’s my takeaway, I mean, from the discussion, and thanks for inviting me. I appreciate it.

Debbie Murphy:

Yeah, thank you.

John Williams:

I’m going to send one more link and this is what air travel via airliner could become that they’re talking about. Just click on that thing and it’ll scare the crap out you. I mean, I don’t even know how long it’s going to take to get from the airport to the airplane, and then from the airplane back to ground transportation. It looks to me like, disregarding flight time, it’ll be an all day thing.

Paula Williams:

Right.

Joni Schultz:

Yeah. Okay, I can’t go on without saying, you do realize that it’s .00 percentage of people passing away from this virus. Okay? I’ve just got to tell you that.

Debbie Murphy:

It just depends whether you have a risk.

Joni Schultz:

Just not talking.

Debbie Murphy:

I have people in my family who, if they catch it, will very likely die because they have no immune system or they have all these preexisting conditions. So that’s the problem, is there’s people who are associated with other people, who we don’t want to die. So I don’t feel like I have that risk, but somebody I know does.

Joni Schultz:

Yeah. Well, then make sure to quarantine. That’s the quarantine to save the-

Debbie Murphy:

Well, there’s people like me who not going to go fly until there’s a vaccine, period.

Mickey Gamonal:

Well-

Joni Schultz:

Then there’s people like me that won’t take one.

Debbie Murphy:

Well, that’s what’s going to drive the economy up.

Paula Williams:

This is America. It’s a beautiful country because we all-

Debbie Murphy:

It’s going to be fewer people participating is all I’m saying.

Paula Williams:

Yeah, exactly.

Debbie Murphy:

Everybody can do what they want, but there’s going to be people like me who are going to keep ourselves out.

Joni Schultz:

Well, that’s fine. I mean, everybody has that choice. That’s the beauty.

Paula Williams:

Mm-hmm (affirmative). They do in some states and not in others though, so it’s interesting-

Debbie Murphy:

That’s true.

Paula Williams:

… how it’s playing out.

Mickey Gamonal:

Cool. So last thing, let’s go ahead and just do a quick plug of our businesses, and then we’ll wrap up. So I’m going to plug mine first.

My business is Gamonal Tutors. I’m focusing on ASVAB, which is the military entrance exam, right now. I’m a Second Lieutenant in the U.S. Military. I just finished Officer Candidate School in April. So I am the guy to go to if you’re joining the military, especially if you’re not getting the score you want or you feel like you’re being misrepresented by your recruiter. That’s what I do right now and that is my specificity, so that’s me.

Paula Williams, ABCI, and we help aviation companies sell more of their products and services, and sometimes people very tangential to aviation, and we made an exception for Mickey because there’s a connection there, and he has the time and the ability to facilitate our book club, so we’re happy that’s working.

John Williams:

And John Williams. I work for Miss Paula and do all the backend stuff, or a lot of it anyway, including the financial side. I do business consulting on the side.

Debbie Murphy:

I’m Debbie Murphy. I am the VP of Marketing for JetBrokers. We sell corporate jets, buy and sell corporate jets. That’s pretty much it.

Paula Williams:

Yeah.

Joni Schultz:

And I’m Joni Schultz. I’m a broker with the James A. Gardner Company and I’m here in Texas. But, Mickey, I need to get your information, because well, my nephew is looking to the military. So I’m going to have you send me your information, because I don’t know that he’s made a decision yet, and I know there’s certain things he wants, so this might be a really good connection. I didn’t even realize that’s what you did.

Mickey Gamonal:

Cool.

Joni Schultz:

So need that information, please.

Mickey Gamonal:

Absolutely. Yeah. Well, thanks. Yeah. So thanks, everybody, for showing up. It was a lot of fun. I don’t have to have the final word, but mom or dad, go for it. But everybody contributed great to the conversation. That was awesome. And then, the last thing is, we’re going to do The Speed of Trust in two week. So personally, I’m pretty early on, haven’t finished the book at all, but it’s already one of those Steven Covey things where it’s just kind of like, “Oh, I should be doing everything in my life right, and I’m doing nothing in my life right.” So get ready for that. That’ll be fun. But yeah, if you guys are down for that, two weeks from now, we can get into it. So thank you.

Debbie Murphy:

Thank you very much.

Mickey Gamonal:

Yeah.

Paula Williams:

Thank you, Mickey. Good job, and thank you, everyone. Very well done.

John Williams:

We’ll see y’all later.

Joni Schultz:

Take care. Bye-bye.

Debbie Murphy:

Bye.

Mickey Gamonal:

Bye.

Podcast: Play in new window | Download

Subscribe: Google Podcasts | Spotify | Amazon Music | RSS

Leave A Comment